Unveiling white oil market outlook with respect to the application spectrum: global industry to be characterized by escalating product demand from the F&B sector

Publisher : Fractovia | Latest Update: 2019-02-19 | Published Date : 2017-05-10Request Sample

White oil market is gaining remarkable impetus lately, perhaps on account of its exponentially surging demand from a plethora of industry verticals. White oil, often referred to as baby oil or mineral white oil is a mixture of highly refined paraffinic and naphthenic hydrocarbons which are derived from crude oil and are extremely versatile & pure. The odorless, tasteless, and colorless properties of white oil have significantly enhanced its penetration across several end-use industries, thereby paving the path for the extensive expansion of white oil industry over 2018-2024.

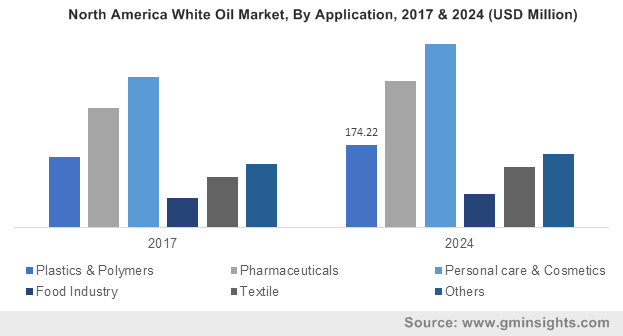

North America White Oil Market, By Application, 2017 & 2024 (USD Million)

Enumerating three principal application trends of the white oil market:

- Increasing white oil consumption as a moisturizer and cleanser in emollient creams & lotions has propelled the growth of white oil market from personal care & cosmetic applications. Equipped with excellent skin compatibility, low irritancy, and resistance to bacteria, white oil finds significant usage in the cosmetic domain. Powered by its superior smoothness, moisture resistance, and extraordinary lubricity, white oil is often used as a base material in baby oils, massage creams, skin creams, and lotions. The rising consumption of the aforementioned products is certain to drive white oil market size from personal care & cosmetic applications, which was pegged at a modest USD 1.5 billion in 2017.

- The food industry is a pivotal application avenue for the growth of the white oil market. White oil is extensively used in food processing, food packaging, food grade lubes, and release agents. Additionally, the approval from regulatory bodies such as the FDA for white oil to be used in applications requiring direct and indirect contact with food will also augment white oil market size from food applications. Incidentally, the food industry is estimated to account for more than 6% of the white oil market revenue share by 2024.

- The global white oil industry is also gaining considerable traction from the plastics & polymers sector, owing to the growing demand for mold release agents and extrusion aids. Back in 2017, white oil market share from plastic and polymer applications was pegged at USD 750 million, powered by the low volatility, high purity, and the paraffinic base of the product that make it ideal to be deployed in plastic applications. As the demand for mold release agents and extrusion aids increases in the plastic manufacturing arena, the commercialization graph of white oil market from plastics & polymer applications is bound to accelerate in the years to come.

Enumerating white oil market trends from a regional perspective, it is prudent to mention that Asia Pacific has emerged as one of major terrains for the expansion of this industry. As per estimates, Asia Pacific white oil industry size was pegged at over USD 2.5 billion in the year 2017, propelled by the product’s extensive adoption rate across the textiles, plastics, food processing, and agricultural industries.

The commercialization graph of the APAC white oil market is also expected to depict a major upsurge on account of the transformation of the continent into a vital manufacturing hub that can irrefutably be credited to the robust influx of FDI policies which are bound to generate lucrative opportunities for major industry participants.

Yet another region that has been projected to amass substantial revenue over 2018-2024 is North America. As a matter of fact, North America white oil market share is anticipated to register a CAGR of 2.5% over 2018-2024. This growth can be undeniably credited to the presence of pivotal manufacturing companies in the region, such as Sonneborn, Chevron Corporation, Exxon Mobil, and more. Reportedly, these companies have taken to adopt vital growth strategies such as capacity expansions in a bid to meet the exponential demand from end-use industries like personal care & cosmetics, pharmaceuticals, plastics & polymers, etc.

The competitive landscape of white oil market, tagged to be moderately fragmented in nature, is replete with a slew of highly exclusive companies such as British Petroleum, JX Nippon Sinopec, Petro-Canada, Exxon Mobil, Renkert, Sasol, TOTAL, Sonneborn, and Royal Dutch Shell. These industry contenders are most likely to adopt product innovation and mergers & acquisitions as their major business expansion strategies in order to gain an edge over their rivals.