Computer engineering market to cross the trillion-dollar frontier by 2024, automotive sector to prominently drive the end-use landscape

Publisher : Fractovia | Published Date : 2018-02-07Request Sample

With pioneering connectivity technologies unlocking potentials in the IoT value chain, computer engineering market penetration is aptly bringing a revolutionary transformation across myriad end-use domains lately. Contemplating on the lucrative opportunities of IoT, numerous data center companies are integrating FPGAs (Field Programmable Gate Arrays) in their operational facilities to outsource computationally intensive workloads. These devices, once reconfigured after manufacturing, are extensively deployed across sectors like automotive, aerospace, military, and industrial sectors. Perhaps driven by the fact that the application horizon of these cutting-edge technologies is practically expanding day by day, it is undeniable that industry demand is on a robust incline. This presumption is validated by an estimation by Global Market Insights, Inc. which claims global computer engineering industry to have pegged a mammoth valuation of USD 1800 billion in 2016.

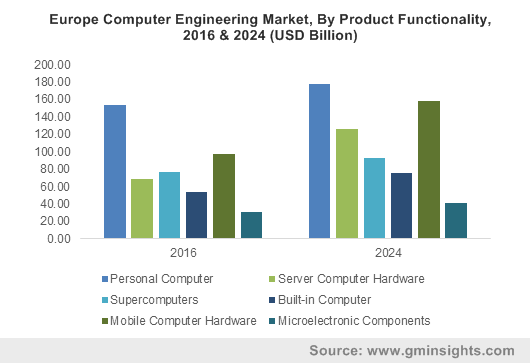

Europe Computer Engineering Market, By Product Functionality, 2016 & 2024 (USD Billion)

Embarking on a barrage of technological advancements such as memory blocks, fast IO, and large gate array-based FPGAs, the profitability quotient of the overall business space is indeed undergoing a turnaround of sorts. In this regard, the emergence of hyper scale data center, primarily based on densely packaged servers, is claimed to bring a disruptive trend in the overall computer engineering market outlook. The shrinking form factor of these aforementioned data centers is driving the demand for FPGA deployment on a large scale, which by extension is set to impel computer engineering industry share. Another pivotal factor that has played its cards in proliferating the industry trends is the development of nanoscale electronic devices. Modern day’s tremendous advancements in the field of nanotechnology has brought exceptional proceeds in ubiquitous computing self-organizing network systems.

Unsurprisingly, the end-use landscape of market is claimed to be versatile and humongous, given the fact that IoT has practically encompassed every object under its canopy. As per reliable estimates- economic impact of the Internet of Things is expected to reach almost USD 3 trillion to USD 11 trillion by 2025. This, in extension would prompt market players to come up with innovative high-end products that simultaneously deliver quick operation as well as holistic intelligence. The automotive sector, undeniably, evolved as a pivotal application domain for the overall business space, given the increasing deployment of infotainment, safety and security systems, smart sensors, and body electronics in connected car systems. In this regard, ON Semiconductors, the U.S. based Fortune 1000 computer engineering market giant reported- in the year before last, 34% of the company’s overall revenue was generated from automotive application.

The far-reaching growth prospects of market from automotive applications is quite vivid from the instances of slew of automakers tapping the driverless vehicle space. A recent instance of the same- software maker NVIDIA and automotive supplier Continental, reportedly, have declared their collaboration in a bid to develop absolutely groundbreaking AI self-driving vehicle systems. The partnership would amalgamate NVIDIA’s computer processing units and AI software features with Continental’s sensor technology to develop the AI technology for electrifying the self-driving cars. Incidentally, through the deal, both the companies are planning to develop AI computer systems that scale from automated Level 2 to Level 5 features, where the vehicle wouldn’t need steering wheels or pedals for driving. Claimed to be built on NVIDIA DRIVE™ platform, the semi-autonomous vehicle for level 3 features is reported to debut in 2021. The collaboration marks a significant importance in computer engineering industry space, given the fact that even the minutest deployment of AI technology necessitates the requirement of advanced semiconductors and microcontrollers.

Given that the competitive spectrum of industry is moderately fragmented, leading manufacturers have been vying with one another to secure their presence in the strategic landscape. On this ground, computer engineering market has been witnessing a slew of mergers and acquisitions over the recent years, where organizations work conjointly on improvising their product portfolios. Say for instance, Infineon Technologies, apparently, had announced the acquisition of Wolfspeed in a deal of USD 850 million, with an aim to exploit the latter’s extensive offering in compound semiconductor systems including the likes of Sic (silicon carbide), GaN-on-Si (gallium nitride on silicon) and GaN-on-SiC (gallium nitride on silicon carbide).

Amidst the backdrop of such a dynamically charged competitive battle, product innovations via R&D investments is deemed to be one of the strongest parameters determining the sustainability quotient for computer engineering industry players. Yet another trend that is lately being observed in the strategic landscape is industry participants’ increasing interest in plant manufacturing partnerships and sales & supply agreements to ensure consumer engagement and apt supply chain models. All in all, the envision to differentiate the product portfolio with detailed consumer insights is certain to bring a renewed dynamism in the overall industry remuneration portfolio, which is slated to surpass a stupendous valuation of over USD 2.5 trillion by 2024.