A comprehensive insight into consumer electronics market with reference to the competitive spectrum: intermittent upgradation and innovation in product development to drive the industry growth

Publisher : Fractovia | Published Date : 2018-02-13Request Sample

A sphere of influence like no other perhaps, in the unified realm of electronics, consumer electronics market, as on today, stands as one of the many instrumental spaces that luxuriates in having established a proximate connection with the masses. Encompassing a widespread assortment of goods ranging from household appliances such as refrigerators, microwave ovens, and vacuum cleaners and home electronics such as television sets, radio receivers, personal computers, to the latest commodities such as smartphones, laptops, tablets, video game consoles, digital cameras, and the like, the product spectrum of consumer electronics industry is a cornucopia of the most fundamental necessities that mainstream consumers demand in abundance. Having recognized that consumer power is the pivotal catalyst for the expansion of this business space, major players in the market have been going the whole hog to periodically come up with an innovative range of products as per the ever-changing customer preferences.

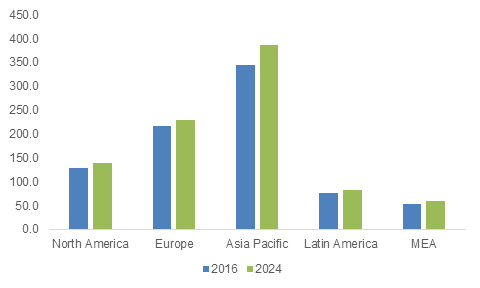

Global Audio & Video Equipment Market, By Region, 2016 & 2024 (Million Units)

A recent instance validating the authenticity of the aforementioned statement is that of Haier Group collaborating with Sogou Inc. The Qingdao-headquartered China consumer electronics market player plans to mark a pivotal shift to the smart space, in consequence to which it has joined forces with Sogou. The collaboration is apparently aimed at focusing on researching intelligent products and terminal devices that can ease communication between consumers and home appliances. This shift in manufacturing has arisen from the indispensable customer demand for product upgradation in an era infiltrated by the internet. The deal is a vivid instance of the efforts undertaken by major industry participants to sustain in this fiercely competitive terrain. Not to mention, these companies have not just been innovating myriad products to keep up with the ever-changing demand, but have also been comprehensively involved in forming strategic partnerships with fellow contenders and SMEs and even conducting R&D programs to ensure that market share soars to great heights in the ensuing years.

An intrinsic outline of the competitive hierarchy of consumer electronics industry is enumerated below:

How Samsung Electronics has been transforming consumer electronics market trends

Always enlisted among the top five majors of industry, Samsung, ever since its inception until now, spanning nearly eight decades, has been one of the most consumer-driven companies in this business space. The firm has earned a reputation of surprising its loyal consumer pool with the choicest of products ranging across myriad verticals. Recently in 2017, the company unveiled a selection of home appliance products designed especially for people facing mobility issues. The collection encompasses smart washing machines, refrigerators, vacuum cleaners, ovens, and air conditioners, incorporated with an ergonomic design and voice support – voice recognition and voice guidance technologies to be precise. For instance, the consumer electronics market player’s line of Family Hub refrigerators is inclusive of special built-in displays that enable color-blind consumers to convert their displays into a black-and-white exhibit.

Samsung’s Induction Range includes a Virtual Flame that lights up, making it convenient for visually impaired customers to manage meal times with minimum fuss. What’s more, the collection also included the Samsung Connect app, optimized with voice support, helping the elderly or disabled users to comfortably enable device control.

More recently, the industry firm, at the CES 2018, unveiled a jaw-dropping modular TV with the ability to scale to any size, making it easier for consumers to buy the required number of bezel-less modules for an optimized screen. Samsung’s efforts to establish a strong connect with their customers through the development of user-friendly components and extensive product innovation seems to have massively upscaled its stance in market.

The contribution of LG Electronics toward changing consumer electronics market outlook

One of Samsung’s patent rivals, LG stands tall as an effectively strong contender in South Korean industry. The company’s brand store boasts of stylish home appliances, home theaters, smartphones, LED computer monitors and projectors, and LED & Plasma television sets, upgraded with highly optimized, user-friendly features, year after year.

Recently, LG made it to the headlines for its plan of partnering with Indian telecom operators, with an aim to launch its products in India consumer electronics market. LG’s appliances, incorporated with SmartThinQ and HomeChat, enable consumers to operate connected appliances through smartphones. Invariably, the company has come a long way from traditional appliance manufacturing to smart product development, having taken a giant leap in the IoT space.

Merely a couple of weeks ago, LG showcased its advanced smart products at the Palais des Festivals in Cannes, southern France. LG’s product portfolio incorporated automated ovens that can choose the accurate settings for cooking, television sets encompassing DeepThinQ, enabling voice-controlled voice commands, and refrigerators that can automatically check food freshness and sustenance. Undeniably, the consumer electronics market firm’s efforts led it to generate 1.87 trillion won from home appliances alone, in Q4 2017 – a far cry from the revenue of 126.31 billion won in 2016.

The changing phase of Sony Corporation in consumer electronics industry

Ranked among the top-notch stakeholders of the market, Sony boasts of a portfolio including TVs, personal computers, telecommunication devices, audio/video devices, monitors, computer peripherals, semiconductors, and other electronic components, Seemingly, Sony’s consumer electronic segment contributes to around 66% of its overall revenue. Ever since its outset, the firm has launched devices that have revolutionized the product spectrum of the market. While Apple’s popularity as a state-of-the-art gadget maker had dimmed down Sony’s acclaim a few years back, 2017 saw the company rise from the ashes, equipped to retain its stance as a prime device maker in consumer electronics market. The firm plans to expand its TV range with a processing engine that can scrutinize a 4K upscaled input and impart a life-like quality onscreen, complete with a color palette and a high dynamic range (HDR). Furthermore, the firm has also enthusiastically adopted the smart space, and plans to innovate a television with an Android platform, that can enable users to command the TV to perform myriad tasks in and out of the house, without having to even move from the chair.

The onset of 2018 also witnessed Sony launching Xperia L2 for selfie-crazy users, incorporated with highly advanced features. Not to mention, Sony’s installed base for the PlayStation 4 amounted to around 73.6 million units – enabling the company to maintain its forte in the industry. Despite severe competition, the firm still reigns supreme as far as core electronics production is concerned.

Being an adjunct of a highly fragmented business space is proving to be particularly taxing for most of the contenders of consumer electronics market. With the advent of high-grade technologies such as IoT and AI, smart manufacturing has indeed emerged as a pivotal dimension of consumer electronics industry. On these grounds, tech giants and other manufacturing companies have been suitably upgrading their production strategies and product portfolios in order to align themselves with the changing dynamics of the market. The imaging photo equipment industry, in particular, has been dealing with this tumultuous blow since a while now – not surprising certainly, given that the advent of smartphone & other digital cameras has substantially lowered the preference for DSLR cameras. However, this paradigm shift has led to major players striving to transition toward the digital space, increasing the scope of the market from the digital photo equipment sector.

Considering the changing technology trends, it is rather overt for the industry to chart out a lucrative growth map in the years to come. Despite the fluctuations that this business space is expected to experience in the near future, it is forecast that it will continue to remain one of the most profitable investment grounds for major stakeholders. Reliable estimates indeed, provide ample evidence to validate the same – consumer electronics market size, apparently, will surpass a mammoth revenue collection of USD 1500 billion by 2024.