Europe data center colocation market to procure hefty proceeds by 2024, wholesale colocation to garner commendable acclaim

Publisher : Fractovia | Published Date : 2019-01-31Request Sample

Escalating complexities across several infrastructure facilities from the integration of new technologies are driving data center colocation market to accumulate sizable gains in recent years. As global enterprises continue to grow, they are encumbered by the difficulties of the integration of network & connectivity devices, making it more complicated to manage the considerably involuted components. The rising complexities of their respective networks are compelling companies across the world to hand over these responsibilities to enterprises that provide colocation services, thereby impacting the growth prospects of global data center colocation market.

China Data Center Colocation Market, by application, 2017 & 2024 (USD Million)

According to a 2018 report by the United States Department of Commerce, the data center industry is witnessing a meteoric rate of growth on both a global & national level. The growth can be attributed to enhanced technologies and market competitiveness that have driven enterprises to shift their responsibilities from premises to independently-operated data centers due to the cost-effective nature of the service. Moreover, while data centers do not generate many direct job opportunities, studies have shown that they are responsible for stimulating job growth across a number of Information & Communications Technology (ICT) industries, further propelling local economic growth, thereby driving data center colocation market trends.

Spontaneous availability of facilities to propel wholesale datacenter colocation market growth:

The wholesale datacenter colocation market is projected to witness substantial growth over 2018-2024, subject to the increasing demands from large-scale enterprises. Wholesale data center infrastructure providers typically construct facilities between 10,000 sq. feet and 20,000 sq. feet or bigger along with a pre-established power & cooling infrastructure and rent them out to large organizations.

Several multinational organizations that require to store extensive amounts of data depend on these service providers to acquire new capacity within a relatively low amount of time when compared to constructing a new facility from ground-up. Once rented, the organizations are responsible for bearing the associated costs of capacity, power internal staff and network connectivity. Moreover, wholesale users also benefit greatly from economies of scale as these services facilitate a reduced power & cooling cost when compared to retail colocation. Attributing to these factors, the wholesale datacenter colocation market is expected to witness a CAGR of over 17% over 2018-2024.

Expanding capacities of colocation data centers in Europe to drive the regional industry trends:

The rapid rate of expansion depicted by the Europe data center colocation market can be strongly credited to the presence of some of the major industry contenders in the region. According to a report by global workplace solutions provider, CBRE, the data colocation centers of Europe depicted substantial growth in 2017, with the region’s top four data center hubs – Amsterdam, Paris, London and Frankfurt, having had a combined colocation supply capacity of more than 1000MW.

Possessing a robust data center infrastructure has now become extremely important for any economy. According to a report by Dutch Datacenter Association, the Netherlands has one of Europe’s strongest data center infrastructure with over 90% of the nation’s organizations possessing high-quality date centers that are less than half an hour away. The nation’s data center market is apparently one of the fastest growing ones in Europe with an occupancy rate of over 82% - a fact that would help propel Europe data center colocation market further.

Rising demands from established & upcoming companies to propel APAC data center colocation market:

The Asia Pacific data center colocation market is expected to accumulate exponential returns in the years to come, specifically on account of the fact that multinational enterprises like Microsoft, Google, Equinix and Amazon have been making the region the preferred destination for setting up their respective data centers. Some of the regions projected to record distinguished growth in the APAC include Hong Kong, Singapore as well as Australia.

It is prudent to mention that the demand for data centers across Hong Kong and Singapore is being driven by cloud service providers as well as other Chinese technology and financial companies. The anticipated demand has enabled IT services & solutions firm, One Asia, to open a six-story 128,000 s.f. data center in Kowloon Bay, Hong Kong. Meanwhile, the primary factor driving growth in the Australia data center colocation market in Australia is the rising number of cloud service providers.

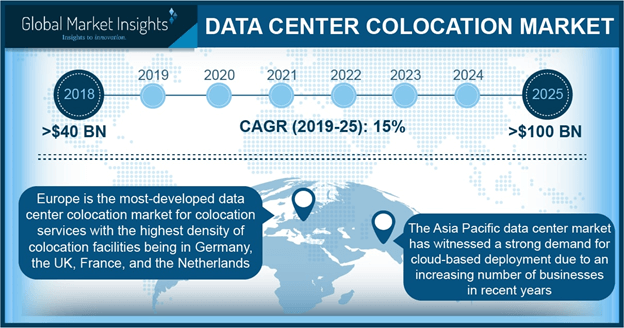

Armed with the need to better serve the expanding data center demands from a plethora of different industry verticals, data center colocation market contenders have been attempting to target their service offerings to enterprises which are establishing operations across the globe and may most plausibly require effective storage facilities for effective data access and maintenance. According to Global Market Insights Inc., the rising data center demands coupled with the ever-expanding infrastructural facilities are projected to mark the global data center colocation market as a $90-billion industry by 2024.