Electronic security market to record a double-digit growth over 2017-2024, APAC to witness phenomenal developments

Publisher : Fractovia | Published Date : 2017-11-21Request Sample

Global electronic security market is claimed to amass remarkable returns in the coming years, inherently propelled by the rising instances of break-ins, property thefts, terror incidents, smuggling contraband and the likes across major economies. The sophistication and complexity of security threats has been rapidly evolving with the advancements of technology, the fundamental factor that has resulted in deployment of advanced electronic security systems much more pronounced in majority of the end-use domains. According to few trusted reports, the total valuation of the stolen property in U.S. is reported to be USD 12.42 billion in 2016. Within a span of two decades (1995-2015), the world has witnessed nearly 2500 incidents of thefts of radioactive materials and trafficking, cite the International Atomic Energy Agency. Electronic security market players seem to be well aware of the need to assess the potential threats and proactively respond to the alarming call of safety and security across vulnerable domains.

China electronic security market size, by technology, 2016 & 2024 (USD Million)

Electronic security industry is certain to reap substantial profits in the upcoming period, courtesy- growing governmental initiatives emphasizing on the adoption of advanced security system in high traffic locations that are more prone to perceived threats such as transit stations, shopping malls, and public roads. The efforts being undertaken by the Indian Government, in this regard, is worth mentioning. Reportedly, the regional government, in the year 2014, had set up a fund of USD 125 million, exclusively dedicated to prevention of sexual violence, for the installation of advanced surveillance system at high risk zones. For the record, these hi-tech hardware systems are equipped with advanced algorithms and video analytics that aids in easy detection of criminals. These encouraging initiatives to ensure public safety and welfare are overt to upscale electronic security industry demand.

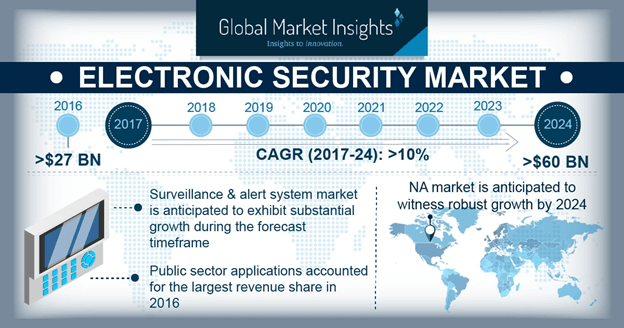

Speaking of the commercialization potential of electronic security market, the overall business space is claimed to record a valuation of USD 60 billion by 2024, as estimated by Global Market Insights, Inc. The proposed figure is reportedly more than double of the market valuation of 27 billion in 2016. Favorable governmental legislations across the globe is expected to gradually mandate deployment of safety and security solutions in majority of the sectors. For instance, in Karnataka, one of the prominent states in India, it is now compulsory to install CCTV cameras surveillance systems in most of the commercial infrastructure premises such as ATMs, pubs, cyber cafes, restaurants, and banks. In addition, it has been also reported that the number of public places coming under the ambit of cameras are surging every month- an affirmation further depicting signs of penetration of electronic security industry in the region.

Regionally, Asia Pacific observes a strong foothold in the global electronic security industry share. The primary reason behind APAC to become the hotspot for electronic security market investors is the real and perceived concerns regarding social unrest and economic growth across this belt. Uptick in industrialization, increasing disposable incomes of the middle-class population, tightened security procedures across airports and malls, and smart city phenomenon are some of the other driving factors, which are expected to result in market specific consumption and would impel APAC electronic security industry share. Another standout issue that has complemented electronic security market growth in APAC belt is the increasing prevalence of religious conflict especially in India, that has remarkably upscaled installation of advanced surveillance equipment in risk prone areas, such as airports.

The competitive hierarchy of electronic security industry is all inclusive of reputed biggies who have been increasingly focusing on novel product development, and innovative merchandizing strategies. Amidst the intense share battle, mergers and acquisitions is one of the major growth strategies underlining the sustainability quotient of the strategic landscape. A prominent instance can be placed as a testament of the fact- ADT, a leading name in North America electronic security market, has recently acquired commercial security business of Protec, Inc, in a bid to reinforce ADT’s position in the regional business space. Allegedly, through this procurement, ADT would not only be able to tap Protec’s extensive consumer base in Northwest America, but would also enhance ADT’s existing security service in national and commercial account domain. The deal was reportedly closed on 31st July, ’17. Some of the other players holding a strong portfolio in electronic security industry space include ASSA ABLOY, BOSCH Security Systems, Thales Group, OSI Systems, Inc., Siemens AG, and RedXDefense LLC.

All in all, with increasing product innovations, favorable governmental initiations toward public safety and security, and increasing public awareness, electronic security market is overt to witness commendable gains over the ensuing years, with a CAGR projection of 10% over 2017-2024.