Fitness equipment market to be connoted by a slew of technologically advanced product developments over 2018-2024, APAC to spring up as the most viable growth ground

Publisher : Fractovia | Latest Update: 2018-11-27 | Published Date : 2017-04-07Request Sample

In an era expounded by sedentary lifestyles but increased consumer awareness subject to health, fitness equipment market seems to have made its mark in more ways than one. Of late, the global populace has been depicting signs of increased lethargy subject to hectic professional lifestyles, which has gradually resulted in a worldwide awareness epiphany, leading to people increasingly pursuing fitness activities.

Fitness equipment industry giants have dutifully acknowledged this dynamic shift, and have been working continuously to bring about a plethora of innovative products for the fitness conscious crowd. As is the case with major domains lately, technology has heavily penetrated fitness equipment market. The manufacture of IoT-equipped multi-functional fitness devices is on a rise, pertaining to the fact that every end-use sector now demands a hefty chunk of the technology space. A recent instance demonstrating the infiltration of technology in fitness equipment industry is that of Apple’s announcement to launch Apple Watch-compatible gym equipment by September this year.

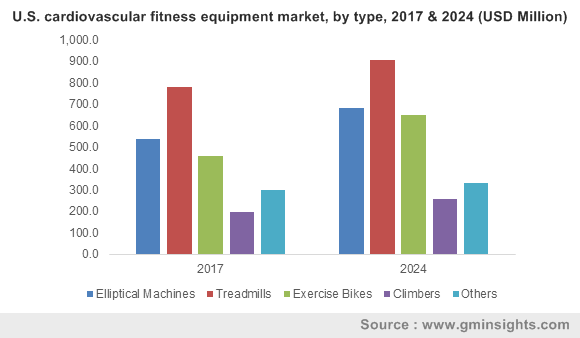

U.S. cardiovascular fitness equipment market, by type, 2017 & 2024 (USD Million)

Apple, a renowned name in the tech cosmos, recently declared at the Developers Conference WWDC 2017 that it will be forming alliances with numerous fitness equipment market behemoths including the likes of Matrix, Core Health and Fitness, Technogym, and Life Fitness, who, between them, manufacture more than 80% of gym equipment globally. If sources are to be believed, the Apple Watch will be equipped with an NFC chip, which, by means of a simple tap, will open up the communication channels for the gym equipment. In effect, the equipment in motion will be able to communicate with the Watch and inform the device about all the fitness details of the person using the equipment. The Watch enabled equipment may ready to be shipped and commercialized by September. With this critical initiative, Apple intends to mark its footprints in fitness equipment market, which is anticipated to cross a valuation of USD 14 billion by 2024.

An insight into APAC fitness equipment industry: The latest hotbed for potential investors

The Asia Pacific region is surprisingly touted to be one of the most opportunistic belts for the growth of fitness equipment market. This change of dynamics since the last few years may be attributed to a barrage of determinants, such as the increasing disposable incomes, the subsequent lifestyle changes, increasing purchasing power, and most importantly, the rising number of cardiovascular and other disorders arising due to lack of fitness and a lethargic lifestyle. In addition to growing health awareness due to fitness drives, the rising spending capacity has also led to consumers willing to expend on luxury goods such as home gym equipment.

Technological advancements in countries such as India, Japan, and China have led to an increase in the sales of wearables and connected devices. Fitness monitors, smartphone apps, fitness trackers, etc., to track consumer vitals have depicted a robust increase in demand, pertaining to rising health awareness levels. A research study demonstrates that one in six consumers use wearable technology, thereby stimulating wearable devices market, eventually bring about a renewed traction in fitness equipment industry. Recently, the Chinese consumer electronics giant Xiaomi surpassed Apple and FitBit to become the number one wearable brand. The contribution of tech giants in the development of APAC fitness equipment market thus, cannot be ignored, and what’s more, these behemoths have been constantly combating with one another to come up with upscaled versions of smart fitness products, and have also been making efforts to establish in-house gyms equipped with 24X7 trainer facility, thereby stimulating fitness equipment industry share from office gyms.

Crucial developments demonstrating the grass-root progress in APAC fitness equipment market:

- Fitness First, a fairly reputed fitness equipment industry participant, had announced a five-year investment program in 2014, with a target investment of around USD 100 million. By 2018, the firm plans to launch 50 new clubs, and expand its footprints by approx. 60%.

- Virgin Active, another gym equipment manufacturer, declared its expansion plans in South East Asia fitness equipment market last year, with an initial investment of GBP 150 million.

- By portraying an exemplary instance of the innovation in APAC fitness equipment industry, UFC Gym launched a novel, state-of-the-art gym in Hanoi, thereby working through its expansion plans in Asia.

India has been touted as one of the most lucrative investment destinations in APAC, for the development of fitness equipment market. The Government of India, for instance, in 2015, had issued orders to establish fitness centers in every department to promote a healthy workplace environment. As per industry analysts, India fitness equipment industry will be extensively driven by the entry of various foreign chains, reduction in import duties, and rising health awareness among Indian consumers.

The scope of fitness equipment market is extraordinarily colossal, say experts. This comes as no surprise, given that more and more people are becoming extremely health conscious. In addition, the rising disposable incomes of consumers have led to an increase in their purchase parity as well as living standards, both of which are inherent drivers of fitness equipment industry. It has been observed that this business space has a rather fragmented value chain, given its massive outlook. Invariably, fitness equipment market offers quite a lucrative spectrum of opportunities for manufacturers, component suppliers, distributers, wholesalers, retailers, and resellers, since the business has been gaining renewed prominence pertaining to extensive awareness programs.

For example, Xenios Fitness, a minority player in fitness equipment industry, made it to the headlines recently for its offering of effective fitness programs through the online distribution channel, which will make it markedly convenient for its clientele across the globe. This feature will instantly offer personal training programs to clients through the company’s app, and allow them to connect to trainers of their choice.

Companies have also been collaborating with software vendors to provide AI-powered personal assistants to their consumers, for a personalized feel. The number of gyms and fitness centers have been on a consistent incline since the last few years and are expected to depict an exponential graph in the ensuing years as well, thereby providing an impetus to the overall fitness equipment market.

Furthermore, it is noteworthy to mention that one of the essential factors driving fitness equipment industry is that of consumer awareness, which is continually being exploited by fitness companies. Most of the fitness equipment market players and even the regional governments have been collaborating with the local fitness clubs and new entrants to launch fitness drives for generating a sense of awareness regarding the importance of health maintenance. Ireland’s 2016 launch of a ten-year National Physical Activity Plan to promote a healthy lifestyle via fitness training is an instance of the same.

Furthermore, these companies also have intensive marketing and promotional tactics on the cards, which will further augment product sale, indirectly spurring fitness equipment industry. The increasing health consciousness among consumers is sure to prompt companies to expand their product portfolios, which will gradually propel fitness equipment market even further, leading this business sphere to register a growth rate of 4% over 2018-2024.