Indian doors market to attain robust growth via rising residential & housing projects, Maharashtra to be a major revenue pocket

Publisher : Fractovia | Published Date : 2017-10-06Request Sample

Fueled chiefly by the thriving construction business and massive governmental funding for infrastructural development, Indian doors market size is expected to witness an exponential increase in the coming years. Rising consumer spending on renovation of residential & commercial buildings has positively impacted Indian doors industry share in the recent years. As per the estimates, the nation’s real estate industry is anticipated to surpass USD 180 billion by 2020 and the private equity investment in real estate across the country registered a valuation of over USD 6 billion in 2016. In fact, housing or the residential sector alone accounted for a substantial 5% to 6% of the Indian GDP, which is one of the pivotal factor that is deemed to fuel Indian doors market trends.

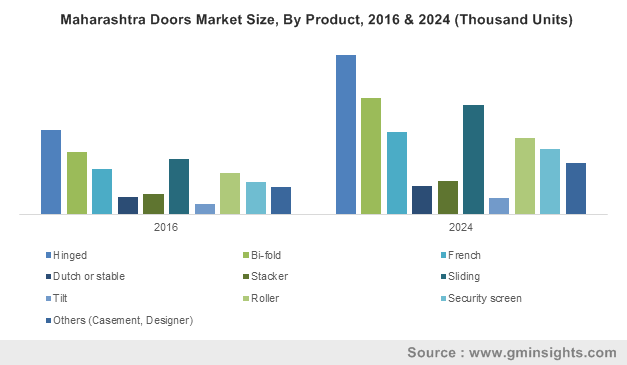

Maharashtra Doors Market Size, By Product, 2016 & 2024 (Thousand Units)

Of late, the prominent industry players have been trying to manufacture technologically advanced doors with high insulation against noise, low maintenance, moisture resistance, fire proofing, enhanced strength, and affordable prices. In addition to this, the companies are also manufacturing products with eco-friendly protection technology for doors, in turn, carving out potential opportunities for the product landscape of Indian doors industry. Speaking of advanced technology, uPVC doors and windows are gaining immense popularity, on account of their advantages including wind, water, thermal resistance, corrosion resistance, dustproofing, easy recyclability, and high sound insulation. Moreover, product versatility in terms of choice of colors, patterns, shapes, and laminates is also supporting the growing demand for uPVC doors across the region. Such beneficial factors are likely to positively leverage uPVC material demand in Indian doors market, which as per estimates is set to grow at more than 8% CAGR over 2017-2024.

Aluminum is another potential material that is widely used for manufacturing doors, owing to its properties like light weight, high durability and ductility, and resistance to corrosion. This material finds particular usage in the manufacturing of French and sliding doors in response to being sound and air proof along with providing insulation against weather. The industry players are focusing on providing advanced and improved aluminum frames that can reduce the effects of overcooling and overheating due to change in the atmosphere. Regionally, the sliding uPVC or aluminum doors have been well accepted, and are thus witnessing a greater demand in Indian doors market. Needless to say, these products have achieved a higher and faster market penetration and are expected to attain significant gains over the coming seven years.

Considering the infrastructure scenario in India, the Planning Commission has estimated an investment that will need to be of the order of Rupees 1450,000 crores or USD 320 billion during the Eleventh plan period to upgrade infrastructure that broadly includes the rail, road, air, and water transport, telecommunications, electric power, water supply, and irrigation. The trend of renovation and refurbishment in the commercial, hospitality, hotels, and residential sectors is set to open lucrative avenues for the Indian doors market expansion. As per estimates, the Indian doors market share from commercial applications is likely to record an annual growth rate of 6.5% over 2017-2024.

India, on grounds of being the second most populous country after China and procuring the second largest urban population in the world, is witnessing a dire need to develop more residential and housing units in the urban as well as rural areas – a factor which is profoundly impacting the Indian doors market trends. Moreover, growing social welfare schemes and subsidies in the nation will further influence the Indian doors market size. For the record, the residential application contributed to more than 60% of the Indian doors industry share in 2016, subject to the growing infrastructural spending in the region.

Speaking of the infrastructural projects, Maharashtra, West Bengal, and Delhi are some of the major regions witnessing robust construction activities in the country. Maharashtra alone accounted for more than 12% of the Indian doors industry share and generated over USD 180 million in 2016. Rapid industrialization and urbanization in the region has escalated the construction projects across the commercial, residential, and governmental sectors, in turn propelling product demand. Taking into account the geographical aspects, this state is the third largest by area and second most populous in the country. Moreover, as per the national population and housing survey of 2011, out of 3.36 crore registered houses, 2.98 crores were in the Maharashtra. Thus, owing to the increasing reconstruction and maintenance activities in the region, Maharashtra is anticipated to generate a substantial momentum in the overall Indian doors industry.

Companies such as Kone, Dorma, D.S. India, Sapa Building System, Reynaers Aluminum, Duroplast, Welltech, and Century form the competitive hierarchy of Indian doors industry. With the rise in infrastructure spending and growing urbanization trends, it is estimated that Indian doors market share will surpass USD 2800 million by 2024. Global Market Insights, Inc., also estimates the Indian doors industry to exceed 9.5 million units over the coming seven fiscals.