Rising robot sales in U.S. and China to augment industrial communication market

Publisher : Fractovia | Published Date : 2019-07-12Request Sample

The advent of the fourth industrial revolution has commendably transformed industrial communication market outlook. The Internet of Things (IoT) and robotics have played major roles in industrially transforming manufacturing systems, with the introduction of digital ecosystems. Automation undeniably, has helped industrial communication market trends to thrive and has advanced the operational work process across numerous sectors. To increase efficiency and productivity in organizations and encourage smart manufacturing, industrial IoT is rapidly being adopted by companies, propelling industrial communication market outlook.

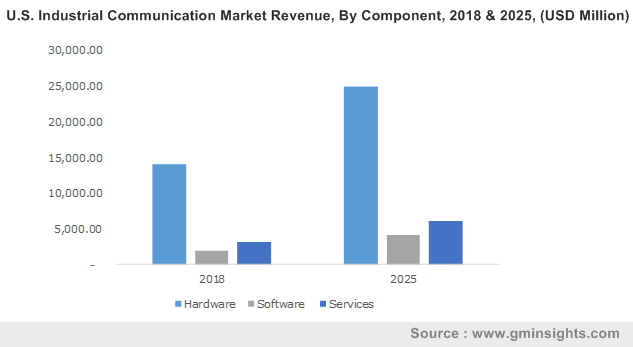

U.S. Industrial Communication Market Revenue, By Component, 2018 & 2025, (USD Million)

In modern industrial processes, the amount of data generated by sensors embedded in machine tools, cloud-based solutions and business management is continuously increasing. IIoT platforms have started to replace MES and related applications, including production maintenance, quality, and inventory management, which are a mix of Information Technology (IT) and Operations Technology (OT).

Industry 4.0 will help make smart machines smarter, factories more efficient, processes less wasteful, production lines more flexible and productivity higher which will redefine new phase of industrialization. Industrial communication market is being positioned to witness unprecedented growth owing to the increasing adoption of IIoT and advent of Industry 4.0.

The increasing degree of robotization and automation in industries has further accelerated the adoption of advanced technologies and added impetus to industrial communication market. In 2018, a new record high of 384,000 units of industrial robots were shipped globally with an increased annual sales volume for the sixth time in a row (2013-2018). In 2019, 30% of commercial service robotic applications have been predicted to be leased which will in turn help to increase industrial communication market share.

China was the largest market for industrial robots and accounted for an annual supply of around 1,332,000 units in the year 2018. Following China, the second largest market for industrial robots was Japan in the same year with an annual supply of around 524,000 units. In 2017, in India, sales of industrial robots reached 3,412 new units installed. In the same year, India ranked no. 14 in the global annual supply, following Spain and Thailand.

Industrial communication market is being driven by robotization trends in industries in the emerging economies of the APAC region. Moreover, the increasing adoption of the Industry 4.0 revolution further augments the prospects for the industrial communication market. Asia Pacific industrial communication market size is forecast to grow at a CAGR of more than 12% over 2019-2025.

Besides APAC region, robot sales in the U.S. has also significantly helped to expand industrial communication market. Robot sales in the United States has been recorded to hit a new peak of almost 38,000 units, setting a record for the eighth year in a row from 2010 to 2018. Robot density in the U.S. manufacturing industry reached 200 robots per 10,000 employees by 2018. Increasing rate of robotization and robot density will drive the industrial communication market substantially.

Among numerous sectors deploying industrial robots, automobile and electronics sectors have been credited with highest share in the year 2018. Automotive sector had accounted for the deployment of 116,000 units of industrial robots whereas, electrical and electronics sector has been credited for the use of 113,000 units of industrial robots. Growing demand of industrial robots is among the key drivers of industrial communication market growth.

Industrial communication market footprint is seemingly strengthened by the industry players in manufacturing, automobile and electronics sectors. For instance, an automation company, ABB, has reportedly announced that it will introduce collaborative robots to medical laboratories as it opens a new healthcare hub at the Texas Medical Center (TMC) innovation campus in Houston, Texas. This new facility will focus on developing non-surgical medical robotics systems. ABB already has its robots operational in food and beverage sector and is playing a significant role to propel industrial communication market growth.

Industrial communication market players are strategically expanding their footprint via new innovations, mergers and acquisitions, market flotation etc. Recently, an industrial communication company, HMS Industrial Networks AB, has made it to the headlines by acquiring all shares in Raster Products B.V., an industrial automation firm. The acquisition will help HMS to build a foundation for increased sales and marketing activities in the Netherlands.

Some other participants in the industrial communication market include ACS Motion Control, Advanced Motion Control, ADVANTECH, Beckhoff Automation, Belden etc. Industrial communication market size is predicted to exceed $160 billion by 2025 owing to the multiplying demand of robotization, automation and IIoT.