Mobile POS terminals market to register a double-digit CAGR over 2018-2024, retail sector to emerge as a pivotal growth avenue

Publisher : Fractovia | Published Date : 2017-04-07Request Sample

With the gradual replacement of hard cash with virtual currency in an era of digital disruption, mobile POS terminals market has rapidly gained traction in the electronics space. One of the most prominent drivers responsible for the growth of this vertical is the increasing realization among businesses that using cash is a highly expensive option. Businesses, especially those in the tight margin retail industry, have come to realize how cost efficient mPOS terminals can be in addition to contributing toward a more fulfilling customer experience.

Currently, close to $17 trillion transactions are still cash and check based, therefore it is obvious that cash or paper checks are nowhere near to being extinct anytime. Nonetheless, experts have come to acknowledge that using mPOS terminals can revolutionize myriad end-use domains, and mobile POS terminals market in response to this massive adoption rate is likely to register a significant growth rate in the ensuing years.

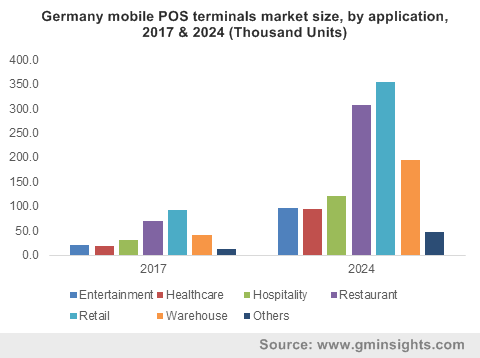

Germany mobile POS terminals market size, by application, 2017 & 2024 (Thousand Units)

On-the-go consumers can be specifically credited for the growth of mobile POS terminals market. Say for example, South Africa’s FlySafair airline has announced the availability of an mPOS system for its in-flight customers who can purchase cash free refreshments on all flights. FlySafair has made it to the headlines to be the first low cost carrier of South Africa to offer such a service. One of the major benefits of incorporating such technology is the ease of providing travelers with receipts regardless of the payment method. This methodology is touted to make it much simpler for travelers to manage their expense claims and will be a blessing in disguise for the travel management teams who have to process and deal with the administration related to travel expenses claims. Presuming that companies across other end-use domains follow the precedent set by FlySafair, mPOS terminals market will gain commendable returns in the years to follow.

The retail industry has been one of the major consumers for mobile POS terminals market, as smartphones and tablets are becoming increasingly ubiquitous and are being more rapidly used by retailers all over the world. This spurt in mobile usage has commenced to not only provide customers with easier payment options but also to compete with digital giants who have been, for a while now, gaining a substantial proportion of the retail industry share. Google swept the headlines when its digital payment platform Google Pay was launched. Under the latest rollout, Contis, a leading end-to-end provider of banking, processing and payment solutions in UK and Europe, has also announced that it is working with Google Pay to offer more customers innovative ways to pay. The company has integrated Google Pay into its end-to-end platform that processes payments in real-time. The aforementioned incidences thus validate the extensive contribution of the retail sector toward mobile POS terminals industry share.

Enabling mPOS payments from mobile devices has proved to be a convenience for both customers and retailers. While customers have been able to bypass the long checkout lines, sales associates have been enabled to provide pricing and product information, order out of stock items and send them to the homes of customers. With more customers carrying smart devices like tablets, phones and wearable technology, alternate means of payment are now in considerable demand. According to the Interactive Data Corporation, an estimated 1.9 billion smartphones will be shipped around the globe by 2019. This humongous surge in smart device ownership will lead to enterprises permitting customers to use their devices in the retail setting, further adding to the growth of mobile POS terminals market from retail applications.

As the payment landscape continues to evolve, the presence of an omnichannel is becoming much more of a reality and can become one of the determining factors for the future growth potential of a business. Mobile POS is the natural next step in a multi-channel payment distribution system to provide customers with a seamless shopping experience across all retail networks. The methodology offers a tangible approach for retailers to create points of connection with customers at the right time and place to build a more robust relationship. In fact, one study noted a 42% rise in sale in enterprises using mPOS than enterprises that do not use mPOS. With the rapidly increasing deployment of these terminals and the expanding growth prospects of the retail, hospitality, and the entertainment sectors, mobile POS terminals market size is anticipated to surpass $55 billion by 2024.