Mobile virtual network operator market to be characterized by an intense competitive scenario, global share to cross USD 120 billion by 2024

Publisher : Fractovia | Published Date : 2018-06-19Request Sample

With the transformational shift in the digital cosmos and the extensively growing demand for smartphones, mobile virtual network operator market has indeed acquired a widespread recognition in the global electronics & media industry. Over the recent years, the growth in the number of mobile subscribers has witnessed a tremendous surge with the global unique subscriber base reaching 5 billion in 2017. A report by the Ericsson Mobility further throws light on the fact that the worldwide mobile traffic accounted for 70% between first quarter of 2016 and first quarter of 2017.

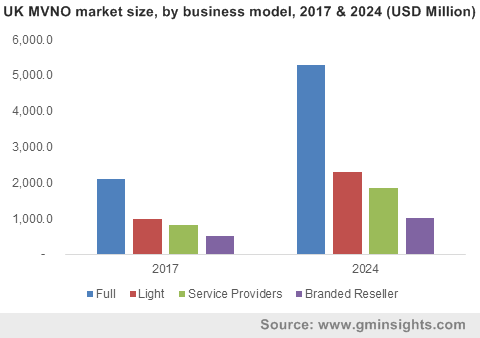

UK MVNO market size, by business model, 2017 & 2024 (USD Million)

Quite undeniably, the mammoth rise in use of smartphones coupled with soaring demand for M2M connectivity and IoT have stood as major trends shaping the business landscape of MVNO market, which was pegged at USD 55 billion in 2017.

The huge growth potential and the fragmented nature of MVNO industry have in turn encouraged a slew of industry magnates to try their hands on the technology. Companies offering voice & SMS services, internet data, and telecom infrastructure are further betting big on service providers and mobile network operators to attract price-conscious customers. Needless to mention, the growing number of industry magnates are outwardly adopting mergers & acquisitions as a major strategy to sustain the competition.

One recent instance is of the merger between Sprint and T-Mobile US that has created quite a stir in the U.S. mobile virtual network operator market, since the duo will be able to rival other prominent U.S. mobile market leaders Verizon and AT&T with their combined expertise. Industry experts have to say that the USD 26 billion proposed merger is certain to affect prices for MVNOs that will leave an influential impact on the regional business sphere. For those uninitiated, unlike Verizon & AT&T, both T-Mobile and Sprint have a substantial share in the U.S. mobile virtual network operation industry and the merger is set to play a central role in the competitive landscape.

Elaborating further, both Sprint and T-Mobile US, owned by Japan’s Softbank and Deutsche Telekom respectively, are the foremost wholesale providers of infrastructure and capacity in the U.S. MVNO industry. Sources also reveal that the U.S. Department of Justice is expected to examine the effect of the merger and the potential impact on the regional MVNO market as the T-Mobile & Sprint combo is projected to account for 54% of the prepaid business in the U.S. This merger is a classic example of the consolidation wave that is being experienced by the developed countries. However, on one hand where it is bound to create a larger consumer base, it is also expected to shift the investors’ focus on new hubs.

Emerging economies of the Asia Pacific belt, in this regard, are forming lucrative growth grounds for potential MVNO market investors looking for opportunities. The tremendous growth in telecom infrastructure development, rising adoption of 3G & 4G services, increasing smartphone penetration and data traffic are some of the crucial factors that are poised to have a lasting impact on the growth dynamics of the APAC region. Speaking of the which, it is prudent to mention that China MVNO market represents a significant portion of the APAC industry, having contributed a lucrative share toward the regional industry. In 2014, the MIIT (Ministry of Industry and Information Technology) China issued around 37 MVNO licenses in the wake of the growing competition in the mobile service sector and recently in 2018, the authority introduced a proposal to issues formal licenses to private firms to sell mobile services.

This undoubtedly has attracted foreign-investment firms in the country that has uplifted the growth of China mobile virtual network operator industry. Given the favorable investment scenario and governmental initiatives, reports forecast the China MVNO market to register a y-o-y growth of 16% over 2018-2024. The data clearly goes on to validate that down the line of six years, China will prove to be a strong participant in the global mobile virtual network operator market with an estimated 59 million mobile subscribers.

All in all, the intense strategies adopted by industry titans to increase their profit margins and favorable governmental initiatives elevating emerging economies to be next lucrative investment hubs are generating excellent expansion prospects for MVNO market growth. A presumption validating the same is of Global Market Insights, Inc., that claims the global mobile virtual network operator market to witness a double-digit CAGR of 12% over 2018-2024.