Launch of new medical devices to drive soft exoskeleton market share through 2025

Publisher : Fractovia | Published Date : 2019-07-17Request Sample

Increasing usage of exoskeletons in industrial, military, and healthcare sectors is driving the growth prospects of soft exoskeleton market. Although the idea of anchoring the body with soft textile materials is a fundamentally new way of using a wearable robot, this technology possesses immense potential to provide mobility assistance or physical therapy for individuals suffering from diseases such as strokes, spinal cord ailments, Parkinson’s and multiple sclerosis.

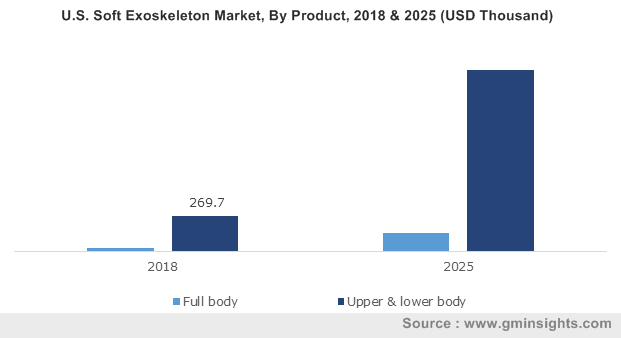

U.S. Soft Exoskeleton Market, By Product, 2018 & 2025 (USD Thousand)

A substantial increase in R&D investments by industry players to improve the exoskeleton technology has emerged as a major factor in boosting the commercialization prospects of soft exoskeleton market share. Owing to these exoskeleton research efforts, a range of new versatile and affordable medical devices are being developed to treat millions of stroke survivors and patients with gait impairment at U.S. rehabilitation clinics. For instance, ReWalk Robotics – one of the foremost makers of robotic medical devices – recently announced that its ReStore soft exo-suit system has been cleared by the U.S. Food and Drug Administration (FDA) for sale in rehabilitation centers across the nation.

Stroke is a leading cause of disability in as many as 17 million people worldwide each year. In this context, the development of highly advanced soft exoskeleton suits and systems like ReStore would assist physical therapists to treat stroke survivors with mobility challenges. Moreover, the applications of soft exoskeletons in enabling effective performance in exercise repetitions of patients in equal amount of time is favoring soft exoskeleton industry trends over the recent years.

Apart from the trend of developing new exoskeleton suits, it has been observed that efforts are being made across European countries to create resource-efficient, light-weight, and flexible prototypes on a collaborative basis. For instance, XoSoft – a European nations-funded project – has brought together nine companies from seven different countries to develop “XoSoft" prototype of a soft exoskeleton. Being developed as a part of an EU research and innovation project, the new prototype would be easy to wear, serviceable, comfortable, and compatible with the daily life of the users.

With each progressing novel technology, the multiple versions of the XoSoft prototype have been developed which in turn were integrated into a single system for clinical and laboratory testing. These prototypes are expected to address various challenges faced by those affected by mobility impairment as they include actuators, sensors, smart materials, monitoring, biomimetic control, and connected health systems, essentially boosting soft exoskeleton market outlook in the longer run.

When it comes to the application spectrum of soft exoskeleton market, the healthcare segment has been witnessing continued growth in the past few years. The launch of new medical devices coupled with a significant increase in the rehabilitation of patients across the globe are the two major factors that have propelled the expansion of healthcare segment of this industry. Additionally, it has to be noted that the application of soft exoskeleton in aiding mobility strengthening individual joints, muscle activations, gloves, geriatric rehabilitation, strokes, paralysis, and spinal cord ailments has led to an impressive spike in the product demand.

Owing to the increasing occurrences of neurological disorders and spinal cord injuries, the upper and lower body soft exoskeleton market size was estimated to be more than USD 700,000 in the year 2018. Growing geriatric population along with increasing investments in the product development would ensure that the upper and lower body product segment remains at the forefront in driving soft exoskeleton industry trends in the forecast years.

Joint ventures and strategic partnerships can be counted among the most prominent strategies being adopted by major industry players including Bioservo Technologies AB, SRI International, Roam Robotics, Daiya Industry, Ekso Bionics, and ReWalk Robotics. Powered by increasing investments in soft exoskeleton research programs by private and public organizations alike would impel the revenue portfolio of soft exoskeleton industry, which is set to surpass USD 3.9 million by 2025.