North America WLAN controller market to register expansive growth over 2019-2025, presence of large number of industry participants to augment the regional landscape

Publisher : Fractovia | Published Date : 2019-05-30Request Sample

The WLAN controller market has recorded an exceptional growth rate in the recent years due to the deluge of new technologies such as IoT, edge computing, serverless, containers, hybrid cloud, and AI that most enterprises are interested in deploying. The implementation of such technologies naturally requires the presence of a secure, robust, self-healing, flexible, software-driven network. Many enterprises are pursuing broader mobility initiatives as WLAN becomes a matured technology.

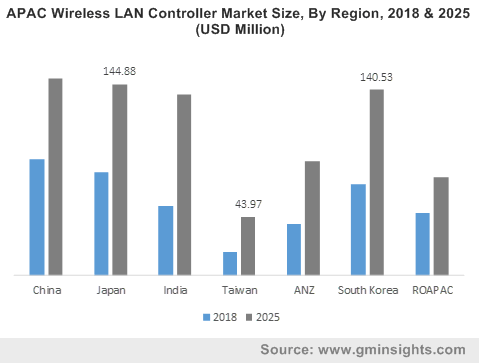

APAC Wireless LAN Controller Market Size, By Region, 2018 & 2025 (USD Million)

Not only big enterprises but medium and small ones are also turning to adopt contemporary WLANs for high-speed access throughout buildings or campuses. As WLANs come to replace wired Ethernet as the primary access method for devices ranging from laptops and phones to printers and cameras, WLAN controllers will find increased application as experts point out that the use of WLAN controllers are worth the investment from a maintenance and management perspective.

The WLAN controller market is slated to surpass $3 billion by 2025 due to the advantages of deploying wireless controllers in the configuration of access points. For instance, wireless access point controllers can automatically find and configure access points instead of the user having to make all the changes manually which can be a time-consuming process. Besides, WLAN controllers can also be advantageous in terms of security and the ability to roam across subnets.

With most businesses creating a massive demand for WLAN controllers (because according to experts, in case there are more than five access points, a WLAN controller becomes a necessity), market leaders like Cisco, Motorola and Aruba are developing WLAN controllers in a range of formats, sizes and licensing options. For example, Cisco 2500 Series Wireless Controllers are small standalone controllers that support 5 to 50 APs. The popular Cisco 5500 Series Wireless Controllers manage 12 to 500 APs. And Cisco Flex 7500 Series Wireless Controllers centrally manage APs at remote branch locations and scale to as many as 3,000 APs.

Speaking of Cisco products, it should be mentioned that Cisco is one of the prominent leaders in the WLAN controller market as the company has established a remarkable and longstanding position in the enterprise networking industry. Cisco is far ahead of its competitors like Juniper and Arista. While the company collected a revenue of $49.3 billion in 2018, its competitors lagged far behind with Juniper amassing $4.6 billion and Arista accounting for $2.15 billion during the same time period. Cisco became a behemoth in the enterprise networking market with not only groundbreaking products but also due to strategic acquisitions undertaken by the company. For instance, Cisco acquired Meraki in 2012. Much of the growth that Cisco registered in the recent years has been attributed to Meraki, as the WLAN portfolio remains one of the chief growth drivers for the tech giant.

Another company that is proving to be a strong competitor for Cisco in the networking equipment landscape is Huawei. The Chinese company has been embroiled in controversies with the U.S. government that has led to its ejection from the U.S. market, however, in Asia, Europe, Latin America, Middle East and Africa, Huawei’s growth projections are anticipated to pose a considerable challenge for Cisco. Other than Huawei, Aruba, Zyxel, Ruckus, Fortinet etc. also account for considerable share in the WLAN controller market.

The presence of a large number of WLAN market participants and large enterprises in North America is expected to drive the growth of the WLAN controller industry in the region. Indeed, North America WLAN controller industry is expected to grow as much as by 40% over 2019-2025. Though the advent of controller-less alternatives has emerged and giants like Cisco are apparently recognizing the importance of such developments for the future of WLAN, controller-based WLANs are not about to be irrelevant in the near future as they are deployed for a variety of enterprise mobility needs.

With greater investment in research and development, consolidation of the business landscape through acquisitions and mergers and the emergence of new entrants, the WLAN controller market is projected to traverse new horizons of growth over 2019-2025.